As I’ve mentioned, I don’t believe the answers to our problems lie with government. But they do have an effect on our lives. And we get a say in our government. So I think it’s worth staying informed and to make our voice heard.

Enter our ridiculously complicated tax system. If you are curious about the new proposal’s contents (it came out today), there happens to be a great bipartisan organization that does analysis on all things tax related: taxpolicycenter.org

Below is a link to their blog with info on today’s proposal. You will find it a refreshing read – it makes no attempt to justify a political position, only to state the facts.

Rather than restating the contents of the blog – because you really should read it – I want to point out something as it relates to the standard deduction, the original nature of income tax, and inflation.

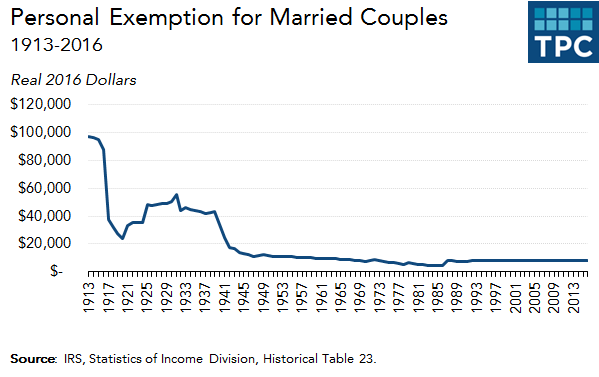

This chart shows the inflation adjusted standard deduction. You can see at its inception (1913), the income tax was intended to be levied against upper middle class and upper class families only. In today’s dollars the standard deduction for a family was $97,000. That’s not a typo. That would mean you would fill out a 1040EZ, pay nothing, and be done taxes for the year. What happened? Mostly inflation and government spending on war being an excuse to lower the deduction. The effect of inflation would be clearer if the chart were in log scale… This goes to show how taxes can be hidden in plain sight by not adjusting for inflation.

My personal opinion. Restore the standard deduction to $97,000 and index to inflation, remove all exemptions except for charitable donations, and then tax all income the same.